Introduction

The Goods and Services Tax (GST) is a cornerstone of India’s indirect tax system, aiming to simplify taxation and create a unified market. However, compliance is critical to avoid penalties, interest, and legal disputes.

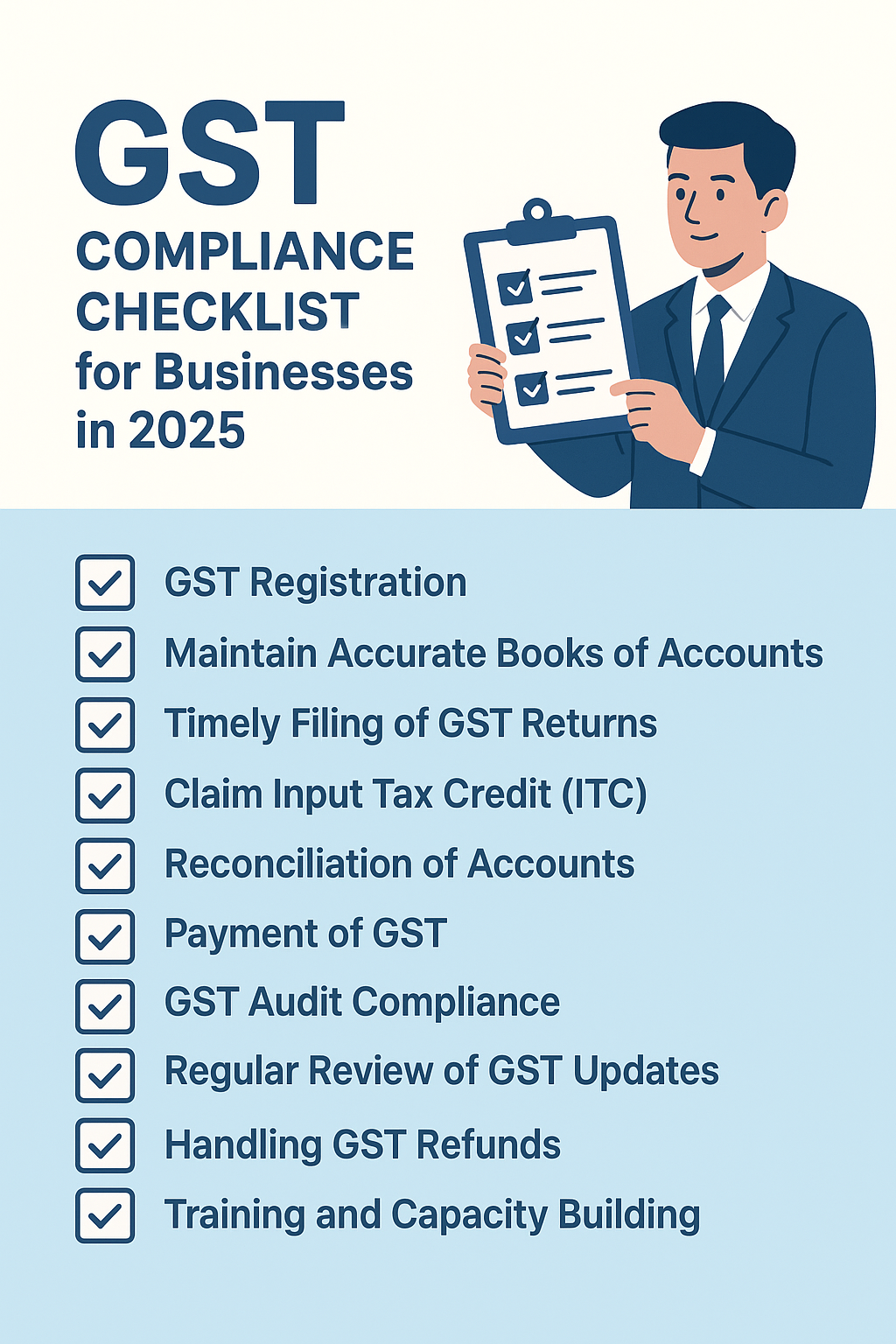

In 2025, with GST rules evolving and reforms being introduced, businesses need to be more vigilant than ever about compliance. A proper GST compliance checklist helps businesses stay organized, avoid mistakes, and ensure timely filing.

This blog provides a *step-by-step GST compliance checklist for 2025* to help businesses of all sizes stay ahead of the curve.

Why GST Compliance Matters

Non-compliance with GST regulations can lead to:

* Penalties and fines

* Interest on delayed payments

* Rejection of input tax credit (ITC) claims

* Disruption in business operations

* Damage to reputation

GST compliance is not just about filing returns — it’s about maintaining proper records, reconciling accounts, and ensuring accuracy in invoicing and payments.

GST Compliance Checklist for Businesses in 2025

1. GST Registration

* Ensure your business is registered under GST if turnover exceeds the threshold limit (₹40 lakh for goods, ₹20 lakh for services, with state variations).

Update GST registration details if there are changes in business structure, address, or nature of supplies.

For startups and e-commerce operators, ensure proper registration under GST TCS rules.

2. Maintain Accurate Books of Accounts

Record all sales and purchases in a systematic manner.

Keep proper invoices for all transactions.

Ensure invoices contain all required GST details: GSTIN, HSN/SAC codes, taxable value, and tax amount.

3. Timely Filing of GST Returns

Key returns to file include:

GSTR-1 – Monthly return of outward supplies (due by 11th of the next month).

GSTR-3B*– Summary return (due by 20th of the next month).

GSTR-9 – Annual return for registered taxpayers.

GSTR-9C – Reconciliation statement (for turnover above ₹5 crore).

*Checklist Tip:*

Maintain a return calendar to avoid missed deadlines.

4. Claim Input Tax Credit (ITC)

Reconcile purchase invoices with vendor filings to avoid ITC mismatches.

Maintain proper documentation for all ITC claims.

Avoid claiming ITC on ineligible items (personal use, exempt goods, etc.).

5. Reconciliation of Accounts

Reconcile GST returns with books of accounts monthly.

Resolve discrepancies before filing returns.

Maintain reconciliation reports for audit purposes.

6. Payment of GST

* Calculate net GST liability correctly.

* Pay GST on or before the due date to avoid interest and penalties.

* Maintain payment challans and proof of payment.

7. GST Audit Compliance

For businesses with turnover exceeding ₹5 crore, ensure GSTR-9C is filed.Maintain detailed audit records, including reconciliations and ITC claims.

Keep audit-ready records for at least six years.

8. Regular Review of GST Updates

Follow GST Council announcements for rate changes, filing requirements, and compliance updates.

Update accounting software and systems to reflect new rules.

9. Handling GST Refunds

Maintain proper records for GST refund claims (exports, excess payment, inverted duty structure).

File refund applications timely using Form RFD-01.

Track refund status regularly through the GST portal.

10. Training and Capacity Building

Train accounting and compliance teams on GST updates.

Use online GST webinars, workshops, and government notifications to stay informed.

Common GST Compliance Mistakes to Avoid

1. Late Filing of Returns* – Attracts penalties and interest.

2. Incorrect Invoice Details* – Causes ITC mismatches and compliance notices.

3. Not Reconciling ITC Claims* – Leads to rejection of claims.

4. Ignoring Notifications* – Missing GST Council updates can cause violations.

5. Non-Maintenance of Records* – Hampers audit and refund claims.

Best Practices for Smooth GST Compliance

Adopt GST-compliant accounting software* – Automates invoicing, return filing, and ITC reconciliation.

Maintain a compliance calendar* – Helps track deadlines for returns and payments.

Work with GST consultants* – Especially useful for complex cases and audits.

Automate invoice matching* – Reduces errors and saves time.

Regularly review compliance* – Quarterly or monthly reviews reduce filing mistakes.

Impact of GST Compliance on Businesses

Proper GST compliance benefits businesses by:

Avoiding penalties and fines.

Enabling faster refunds.

Improving financial record accuracy.

Strengthening credibility with suppliers, customers, and investors.

Ensuring smooth business operations without legal interruptions.

Future of GST Compliance in India

The government is pushing towards:

Single monthly returns* – Reducing compliance complexity.

Pre-filled returns* – Simplifying filing.

AI-driven compliance tools* – Automated verification of returns and refunds.

Integration with accounting systems* – Minimizing manual intervention.

These changes will make compliance easier, especially for SMEs and startups.

Conclusion

GST compliance is not optional — it is a vital part of doing business in India. In 2025, businesses must adopt a proactive approach to compliance to avoid penalties and maximize benefits like input tax credits and refunds.

A GST compliance checklist is not just a filing guide — it’s a framework for efficient tax management, improved cash flow, and sustainable growth. Businesses that adapt to GST requirements with technology, training, and discipline will find themselves better prepared for India’s evolving tax landscape.

FAQs – GST Compliance

Q1. What is the first step in GST compliance for a business?*

GST registration and maintaining proper books of accounts.

Q2. How often should GST returns be filed?*

Mostly monthly (GSTR-1, GSTR-3B), but annual returns are required once a year.

Q3. Can ITC claims be carried forward?*

Yes, but must be claimed within specified timelines and with proper documentation.

Q4. What happens if GST returns are not filed on time?*

Penalties and interest are charged, and compliance records may be affected.

Q5. How can businesses simplify GST compliance?*

Use accounting software, maintain a compliance calendar, and seek expert advice.